Dollar's Clout Sinks Worldwide

Posted: Fri Mar 14, 2008 12:12 am

DAR

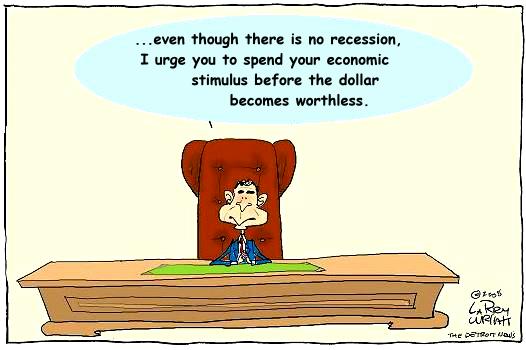

$110 for a barrel of oil. $1,000 for an ounce of gold. There was a time when you could buy a euro for 89 cents (now it's $1.55). That was before Bush wrecked the country with his 3 trillion dollar illegal war.

But no need to worry, Mr. Boosh has a "strong dollar policy."

Dollar's Clout Sinks Worldwide

By Alan Clendenning

The Associated Press

Thursday 13 March 2008

Sao Paulo, Brazil - Antique store owners in lower Manhattan, ticket vendors at India's Taj Mahal and Brazilian business executives heading to China all have one thing in common these days: They don't want U.S. dollars.

Hit by a free fall with no end in sight, the once mighty U.S. dollar is no longer just crashing on currency markets and making life more expensive for American tourists and business people abroad; its clout is evaporating worldwide as foreign businesses and individuals turn to other currencies.

Experts say the bleak U.S. economic forecast means it will take years for the greenback to recover its value and prestige.

Negative dollar sentiment is growing in nations where the dollar was historically accepted as equal or better than local currency - and dollar aversion is even extending to some quarters in the United States.

At the Taj Mahal, dollars were always legal tender, alongside rupees, for entry into the palace. But because of the falling value of the dollar, the government implemented a rupees-only policy a month ago. Indian merchants catering to tourists have also turned bearish on the dollar.

snip...

The dollar has steadily eroded in value against the euro and other currencies since 2002 as U.S. budget and trade deficits ballooned, but fears of an American recession and credit crisis have sent the dollar to stunning lows amid predictions the slump will continue for a long time.

The euro traded for a record $1.5625 before declining to $1.5586 Thursday while the dollar dropped below 100 Japanese yen for the first time since November 1995. It traded as low as 99.75 yen before recovering some ground to 101.68 yen. The dollar also recently hit a 10-year low against the Chilean peso, and fell to its lowest level against Brazil's real since the nation floated its currency in 1999.

While low dollar cycles have come and gone for decades, experts caution that it's now much more difficult to predict when this one will end because the euro didn't exist as competition for the dollar before.

...snip...

The problem right now, is that "people just don't want to be holding U.S dollars and U.S.-based equities," Sylvester added. "If you are an investor with a million dollars to invest, you look for the highest yield - you're looking at South Africa, Australia, New Zealand."

LINK

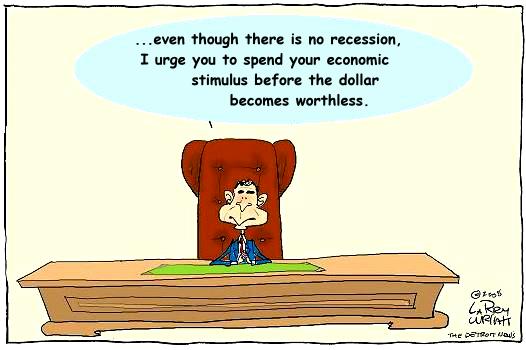

$110 for a barrel of oil. $1,000 for an ounce of gold. There was a time when you could buy a euro for 89 cents (now it's $1.55). That was before Bush wrecked the country with his 3 trillion dollar illegal war.

But no need to worry, Mr. Boosh has a "strong dollar policy."

Dollar's Clout Sinks Worldwide

By Alan Clendenning

The Associated Press

Thursday 13 March 2008

Sao Paulo, Brazil - Antique store owners in lower Manhattan, ticket vendors at India's Taj Mahal and Brazilian business executives heading to China all have one thing in common these days: They don't want U.S. dollars.

Hit by a free fall with no end in sight, the once mighty U.S. dollar is no longer just crashing on currency markets and making life more expensive for American tourists and business people abroad; its clout is evaporating worldwide as foreign businesses and individuals turn to other currencies.

Experts say the bleak U.S. economic forecast means it will take years for the greenback to recover its value and prestige.

Negative dollar sentiment is growing in nations where the dollar was historically accepted as equal or better than local currency - and dollar aversion is even extending to some quarters in the United States.

At the Taj Mahal, dollars were always legal tender, alongside rupees, for entry into the palace. But because of the falling value of the dollar, the government implemented a rupees-only policy a month ago. Indian merchants catering to tourists have also turned bearish on the dollar.

snip...

The dollar has steadily eroded in value against the euro and other currencies since 2002 as U.S. budget and trade deficits ballooned, but fears of an American recession and credit crisis have sent the dollar to stunning lows amid predictions the slump will continue for a long time.

The euro traded for a record $1.5625 before declining to $1.5586 Thursday while the dollar dropped below 100 Japanese yen for the first time since November 1995. It traded as low as 99.75 yen before recovering some ground to 101.68 yen. The dollar also recently hit a 10-year low against the Chilean peso, and fell to its lowest level against Brazil's real since the nation floated its currency in 1999.

While low dollar cycles have come and gone for decades, experts caution that it's now much more difficult to predict when this one will end because the euro didn't exist as competition for the dollar before.

...snip...

The problem right now, is that "people just don't want to be holding U.S dollars and U.S.-based equities," Sylvester added. "If you are an investor with a million dollars to invest, you look for the highest yield - you're looking at South Africa, Australia, New Zealand."

LINK