http://www.skepticmoney.com/what-should ... t-default/

Also: zfacts

And:

LINK

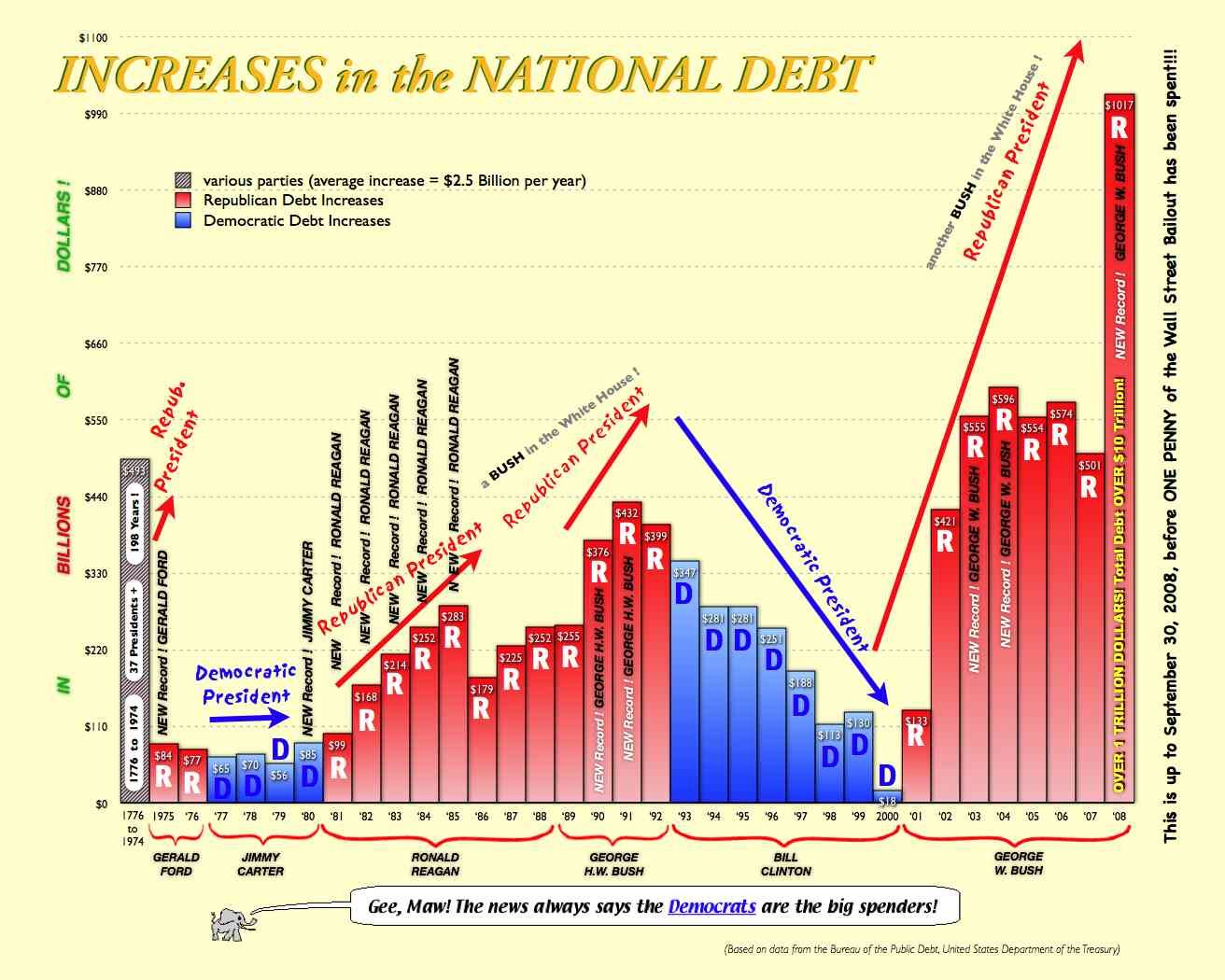

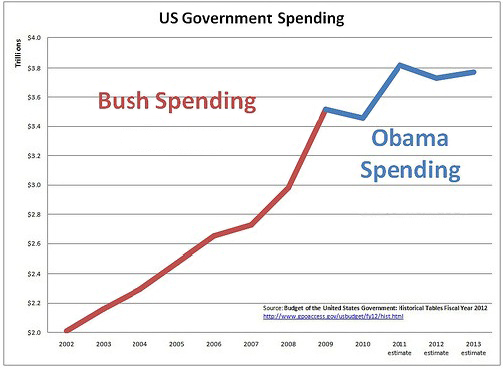

Maddow explained that the Republican talking points always stay the same against Democrats, even when they don’t make sense. The MSNBC host also pointed out that the Republican invectives have become disconnected from what is actually happening in governing."It’s a default Republican talking point to accuse all Democrats of wanting to grow government and to say that instead government should be shrunk. Despite that Republican talking point, government did grow more than at any time since World War II under their Republican president, under George W. Bush and a Republican congress, and this Democratic president is proposing shrinking government, but that will not interrupt the talking point, which alleges exactly the opposite of what’s really happening.

It’s the same thing on taxes on regulations. It is a default Republican epithet that Democrats want to increase taxes and they want to increase regulations…So they say not only does President Obama want to increase taxes and regulations, he already has. And while that talking point is a tried and true talking point, it’s an applause line, right? What the Obama administration has actually done bears no resemblance to the talking point, and is therefore a bit of a flabbergast for Republicans on this.

In January of last year, it has gone down the memory hole for Republicans, but President Obama issued an executive order and wrote an op-ed in the rabidly right wing Wall Street Journal editorial page calling for a government wide pruning of unnecessary or overly burdensome regulations. In February of 2009, President Obama implementing either the largest or one of the largest middle class tax cuts in American history. That was part of the stimulus actually, but you’d never know it from the way that the Republicans talk about it. The administration also brags on having passed 17 tax cuts specifically for small business. So naturally, keep denouncing him as raising taxes, piling on the regulations, and raising taxes.”

Ok, let's see.....

Our forum is open to all political persuasions Mr. Ghost. We have had dozens of rightwingers around here over the years but for some reason they tend run off rather after their factual errors are repeatedly exposed. If your side is under represented there is nothing I have done or can do to help you out with that, so please stop wanking about it and get to work making your case for why your conservative beliefs are so grand. I am open to being swayed by strong arguments. Let's see how your complaints regarding these ten examples showing the US is a low tax country, hold up to examination.ghost wrote: Once again, your "freethinking" forum shows there's isn't much free thought, just what the left spews.

So you concede this one with a shrug and by pointing out that it's "not a shocker." I'll take it. I guess we're done, oh wait, I see you have more...Chart 1. Interesting, but what does it tell us? Revenue is low because unemployment is high and the economy is in a slump. Not a shocker there.

So the US is low tax, as per the claim, but because we have a high GDP, this some how effects the claim? Of course it doesn't. And it makes perfect sense to look at taxation in relation to GDP. Perhaps if you were aware that many of those countries to the right on that chart (higher taxes) also have a higher GDP per capita, than the US you wouldn't have said this. So while your excuse is irrelevant to the claim you are attempting to rebut, it also is wrong.Chart 2. Also interesting. Especially given how much money we spend, I'm thinking it's because our GDP is so high that gives us a smaller share.

Actually, we don't know that. I find taxes in Arkansas extraordinarily low, and quite a bargain. The teabagger and Paulist movement is based wanking about high taxes, but as this chart shows (and I have provided no end of evidence for this in this thread), these people are just factually incorrect and profoundly, stupendously ignorant of the facts with regard to taxes. Your reference to federal and military spending, while a nice wank, has no relevance whatsoever to the topic in question....we know that local and state taxes have been doing nothing but going up, and there's a ton we can cut federally on military and worthless departments.

Really? It's rather simple (and you've pretty much conceded this out of the gate). As per the claim in the title, it shows that in relation to other peer countries, the US is low tax. What part of that is giving you difficulty? The part about your being unable to refute it? Yes I think that's it.So I'm not sure what this chart is really telling me.

Yes, because these other countries don't borrow money when in a Great Recession do they? Your claim doesn't address the assertion at all. Again you show you haven't examined this issue very closely. Many of those countries to the right on this chart (higher taxes), also have higher, or very similar levels of debt. Try again.Also, it's easy to have "low" taxes when you're borrowing 40% of what you spend instead of taxing the people for it.

A typical conservative mistake. Your claim is not true. You confuse (and this is very typical) debt, with deficit. If you deny this, I'll hold your hand and walk you through it.If we balanced the budget tomorrow using nothing but tax increases (just hypothetical, because that wouldn't be possible),...

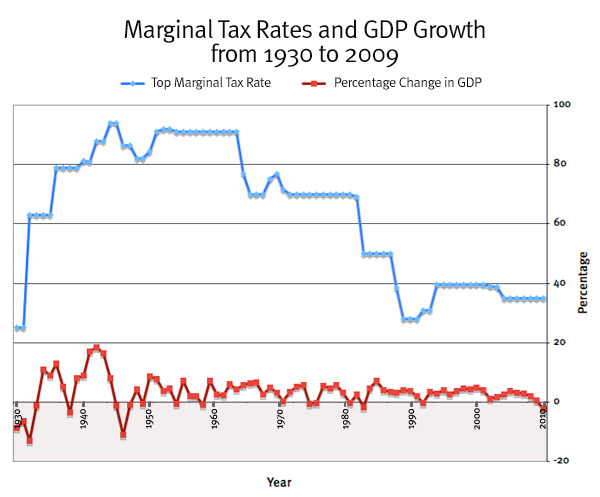

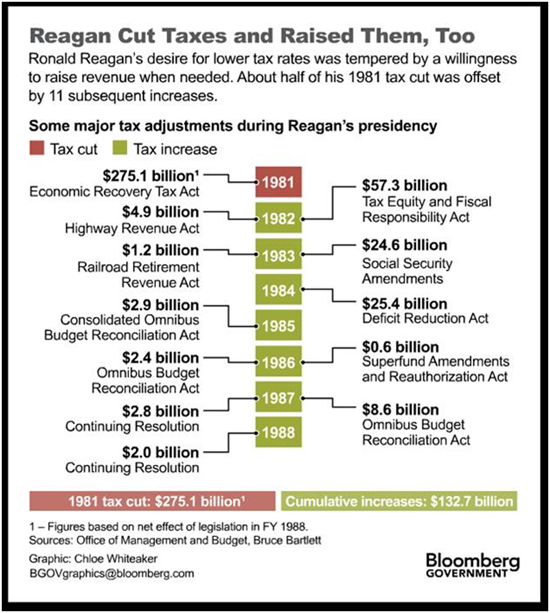

a) That's funny. Showing that our top tax rates are historically low (which they are), isn't relevant to the claim that the US is, present day, low tax? Sorry, not buying it.Chart 3. This doesn't belong in the argument at all. First off, it doesn't compare us against the rates in other countries,

You want to hand wave away the category of "income tax" because it is "one of many?" That's absurd of course. You really ought to think about things before you post them. Typing words in a row don't necessarily an argument make. The tea doesn't get weaker than this.next the marginal rate alone doesn't tell us much, and it's only talking about personal income tax...which is one tax of many.

This chart obviously goes beyond the concise assertion in its 12 word title to show that not only is the US low tax in relation to other countries, it is also currently low tax in relation to its own historical precedent. Sorry if that wasn't clear. Teabaggers and Ron Paulists don't like this because it rather cuts the nuts off of their main plank and reason for existing. Next:In other words, this chart gives no information that supports us being a "low tax" nation.

Compared to our historical precedent. This makes a farce out of your main conservative wank: that taxes are too high.Chart 4. This chart also doesn't compare our capital gains taxes with other countries. So is this low? Compared to what?

Hey, when you don't have an argument, best to just be quiet about it and not tackle a list like this if you don't have any water for your squirt gun.The past? Yeah, I can see that. But chart 2 is comparing us to other countries. So what comparison are we making here?

Meaning, you don't have any way to rebut or deal with the fact that example #5, like example #4, provides us yet another reason to understand that the US is currently, low tax.Chart 5. Same as 4.

When your response to an opposing argument is reduced to "this isn't a surprise," that's not exactly a counter argument, it's a concession. I'll take it.Chart 6. This isn't a surprise, given that the wealthiest are making most of their money from investments taxed at 15%.

I really enjoy this one. So while it's obviously the case that overwhelming those making over $1 million per year, will be millionaires, because it isn't so in every single case and there will be a few exceptions, the "chart is meaningless?" That is a good one. I hope you stick around Mr. Ghost, I am quite enjoying your softballs.Also, The chart and the description have a discrepancy that needs to be addressed. The chart says the red line is households with more than $1M in income, and the description says "millionaires". Those aren't the same thing. I assume that the chart reflects the former and the description is wrong, but if that's not the case, then the chart is meaningless.

No I don't think so. You just don't like what this chart shows.Chart 7. We need more information to determine what's going on here.

The chart is measuring corporate tax revenue as a share of GDP. This shows the Teabagger Paulist wank of high US corporate taxes is just more rightwing ignorance (68% of US corporations don't pay tax and out of the top 30 nations in the OECD, the US comes in 4th from last in collection).Many US companies have business units outside the United States that aren't subject to US tax, but their earnings are disclosed in aggregate. So we need to know what this chart is actually measuring.

If corporations can't pay taxes, why are the Teabag Paulists always wanking about the US taxing corporations too much? I can bury you in examples if required.Also, it's really all moot, corporate tax rates should be zero because corporations can't pay taxes.

More weak tea and non-rebuttal. Two points:ghost wrote: Chart 8. This chart is deceiving because it says we generate "much less" revenue from corporate taxes than "other countries". Yeah, it looks like just a few. The rest we seem to be right in line with.

Meaning, you've got bupkis in rebuttal, again. That US corporations are taxed less than their foreign rivals provides excellent evidence in favor of the affirmative made in this chart, and again you've got nothing.Chart 9. Similar arguments from 7 and 8 also apply here.

So then you go on to agree with the chart, but wank about why it is the case that the chart is true. So yet another concession. Little tip: perhaps you should have considered whether you actually had a case to make against these ten charts, before you began your endeavor?Chart 10. Best chart in the whole bunch, not a surprise, and shows exactly what's wrong with our government.

Ah, the best for last. Each and every chart is perfectly relevant to the thesis that the US is, present day, low tax in relation to other countries and in relation to its own historical precedent. You in fact were reduced to conceding several of these charts as "obvious." The rest of the time you were shooting blanks as was easy to show. Not at any point did you attempt to show anything is an example of the fallacy of cherrypicking. But hey, it's always good to throw in an unsupported charge of a fallacy before you go. None of your posts would be complete with out it.But mostly, this is a bunch of cherry picked data.

Hey, keep voting for conservatives and they'll make you pay more, and Warren Buffet pay less. Or better, they'll lower your taxes, borrow more and pass it on to your kiddies, with interest. See G.W. Bush who alone is responsible for about half (seven trillion) of our total debt. You voted for him didn't you?ghost wrote:On my middle class income, I'm paying about 35% of it to taxes. Federal, state, and local. I'm sure the figure is conservative,...

How is that relevant, to anything? Buying alcohol is voluntary and hardly covers the cost to society and the fees on utility bills are a bargain. Rightwingers, they like living in a society but they'll be damned if they have to pay for it! Pathetic.I don't have a good way to quantify all of the extra little taxes like those on alcohol or franchise fees on utility bills.

Same as above.It's also impossible to quantify the amount of the corporate tax I'm paying that's buried in the goods and services I buy,...

A standard conservative canard, and not true. For instance, the actual federal percentage collected, minus you dreaming about taxes buried in your box of Cornflakes, from the conservative Tax Foundation:It wouldn't surprise me at all if I was actually paying about half of my income to taxes. Hardly what I would consider to be low.

When I saw this cartoon I thought of Mr. Ghost and his hand wringing about his taxes. I hope it doesn't commit any fallacies:ghost wrote:On my middle class income, I'm paying about 35% of it to taxes. Federal, state, and local. I'm sure the figure is conservative,...